Ecological concerns over issues such as air quality or toxic radiation drive much progressive change, but as often as not, money prompts change. For example, early adopters installed rooftop solar mostly because it’s ecologically responsible, but it’s a dropping price point that attracts the average customer. Or, electric utilities initially installed wind generators because of lawsuits or regulations over coal pollution, but anymore, wind power is booming because its cost has dropped below that of coal.

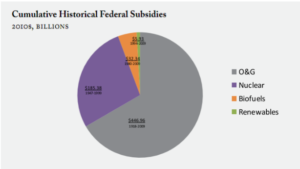

However, as sound as this principle is, and as likely as the profit motive will bring some ecological solutions, major money players can manipulate the market to their own ends. Some examples of market distortion are: fracking operations proliferating in spite of losing money, nuclear power revival though it’s not cost-competitive with any other energy source, and corn ethanol fuel that takes as much fossil energy to make as is in the ethanol itself. Each of these can survive only because of large subsidies.

Fracking Subsidies: Fracking petroleum and natural gas is one of several “extreme energy” measures like deep sea wells, oil sands, and mountain top coal removal. All of them cost more than the old, easy, conventional fuels, but fracking costs so much more for extraction, that they actually sell the energy at a net loss. Their higher cost result from things like drilling deeper, drilling more wells that produce less energy, more complicated horizontal drilling, acquiring and disposing of process water, drilling in more remote areas, and more costly transporting the energy to markets (sometimes with disastrous consequences).

An article by Justin Mikulka in the journal “Resilience” summarized the ongoing failure of the fracking industry to make a profit. Mikulka asks “Who would be foolish enough to produce more oil than the existing infrastructure could handle?” He explains that “Frack operators across the country seem to have resisted the urge to reign in production and instead produce in excess. Unsurprisingly, this is not a recipe for profits”. But the fracking industry manipulates the numbers to appear profitable, in collusion with finance banks. Mikulka writes “It’s the Wall Street executives who are getting rich making the loans that the fracking industry struggles to repay”. It’s truly a perverse dynamic where banks could be choosing to invest in renewables, but greedily grab the gold from the option with the highest interest rates – climate-killing oil and gas – World’s Biggest Banks Are Driving Climate Change, Pumping Billions Into Extreme Fossil Fuels.

Nuclear Subsidies: Some outliers profess that nuclear electricity is carbon-free, and could be a key climate solution (ignoring the critical toxic waste costs for 10,000 years). First of all, nukes do produce CO2, from the uranium mining and milling and the immense use of concrete containment buildings. According to a report in Clean Technica, “The U.S. could achieve three times as much CO2 savings with renewables instead of nuclear, and for less money”. Nuclear makes little sense economically or environmentally. Although nuclear could replace gas and coal, we can go further faster with wind and solar.

There is no rational explanation for any substantive investment in nuclear power. Utility scale solar is about the same CO2 output as nuclear, while wind is about half of either. By deploying a 50:50 mix of wind and solar instead of nuclear, there would be 150 million tons of savings of CO2 per year over nuclear. And wind and solar are a lot cheaper than nuclear. Right now unsubsidized onshore wind and solar are under $40 per MWH or 4 cents per KWH, and many places are already seeing $20 per MWH. That’s 2.5 to 7.5 times cheaper than the nuclear. Learn more at – US Could Achieve 3 Times As Much CO2 Savings With Renewables Instead Of Nuclear For Less Money.

So how can there be attempts to revive nuclear energy? Through governmental subsidies in several countries including the U.S., France, England, Japan, and China. In 2017, a proposal by the Donald would have given an estimated $10.6 billion annually to nukes and coal. But when that idea crashed and burned, several states have passed bailouts, like the $300 million in Ohio, the potential billions in New York and New Jersey, and Federal low interest loans of $12 billion in Georgia to construct the over-budget Vogtle nuke. Without this “good money after bad”, nuclear energy would collapse under its own weight, leaving the money to real solutions through renewables – The Green New Deal Promises Peace and Progress. Will Nuclear Advocates Undermine it?.

Corn Ethanol Subsidies: It may have seemed apparent to members of Congress in 2005 that if a motorist pumped a gallon of fuel made from corn into their gas tank, a gallon of fossil fuel would be left in the ground. So they passed the Renewable Fuel Standard which mandates that gasoline contain a minimum of 10% ethanol. But the 1-gallon per 1-gallon ratio is a simplistic myth, and it’s now apparent that ethanol exacerbates climate disruption. Studies by the International Institute for Sustainable Development have found “that the CO2 and climate benefits from replacing petroleum fuels with biofuels like ethanol are basically zero.

Producing ethanol uses more energy than is contained in the resulting fuel, according to Cornell ecologist David Pimentel. The reason is the corn crops are grown with fossil fuel intensive machinery and inputs, to prepare the fields, plant the seed, cultivate the crop, fertilize and pesticide it with fossil fuel inputs, harvest it, dry it, and transport it to an ethanol refinery. So once again, follow the money to the bottom of this scam. Cargill and Archer Daniels Midland (ADM) are the main benefactors of increased Federal subsidies to agribusiness and tax credits to ethanol refiners – The Real Scoop on Biofuels.

BlackRock Divesting from Fossil Fuels: In contrast to such subsidized market distortions is a recent announcement by Blackrock, the world’s largest investment management corporation, with $6.96 trillion in assets under management. If the estimate is accurate that there’s about eighty trillion dollars of money on the planet, then BlackRock holds 10% in its portfolio of stocks and pension funds and the like. So there was a seismic shift felt when BlackRock acknowledge the urgency of the climate crisis, and said it will begin to start redirecting its investments. They have a considerable percent of funds in fossil fuels which have been underperforming, with some $90 billion losses to date.

Climate campaigners have been targeting BlackRock for years, and their CEO, Larry Fink, had conferred with Pope Francis who urged leading corporations to shift to renewables. But it was the $90 billion value destruction that brought BlackRock to its decision. According to a report by the Institute for Energy Economics and Financial Analysis (IEEFA), “Out of BlackRock’s $90 billion in estimated losses, 75% are due to its investments in four companies alone – ExxonMobil, Chevron, Royal Dutch Shell and BP”. Because of its sheer size, BlackRock is hugely influential in the financial sector. Kingsmill Bond, an analyst who used to work at Citibank and Deutsche Bank, “I, for one, see this as the beginning of the end for the fossil-fuel system”. Learn more at – Is BlackRock announcement “beginning of the end for fossil-fuel system?”, and Citing Climate Change, BlackRock Will Start Moving Away from Fossil Fuels.

Recent Comments